Strange as it may seem, gold is quite widespread in the world around us. It is present even in the human body. However, according to the content of elements in the earth’s crust, gold occupies only 61st place or less 0,000001%

by weight. The fact is that gold in the environment is in an extremely dispersed state.

Territories where gold can be found in significant concentrations are very rare. Such places, if gold can be mined industrially, are called deposits.

In addition to deposits, gold (sometimes in significant concentrations) can be found in small deposits, placers, and so on, which are of no industrial importance.

TOP 10 deposits where 90% of gold is mined worldwide

The Top 10 gold deposits presented are based on 2014 production data, and only in some cases 2015, because this is the latest data set that is updated for the entire gold mining industry. Some of the companies on this list publish their production results annually. In our listing of companies in this industry, we consider any company with a complete production cycle to be a gold mining enterprise, even if it includes one or more open pits and underground mines.

At the moment, one of the gold mines produces twice as much as any other on the list - Muruntau. The Uzbek field is state owned. Data on gold reserves at Muruntau indicate that it is a remarkable source of gold for this country, as its reserves are 2.5 times greater than the preliminary reserve estimate of any other mine on the list.

✰ ✰ ✰

10

Boddington, Australia

The Boddington field is located in Western Australia near the city of Perth. Mining in Boddington is carried out by open-pit mining. In 2014, 700 thousand ounces of gold were mined here. There are believed to be another 20 million ounces in reserve.

Mining at the Boddington gold mine began in 1987 through the joint efforts of Normandy Mining (44.44%), Acacia Resource (33.33%) and Newcrest Mining (22.23%). Production ceased in 2001 when known reserves of oxide ore were exhausted. Newmont bought out Newcrest Mining in 2005 and Acacia Resource in 2009, allowing the company to take a majority stake in the Boddington gold mine. Mining resumed the following year, quickly elevating Boddington to the list of top gold mines.

✰ ✰ ✰

9

Veladero, Argentina

The Veladero mine is located in the San Juan province of Argentina, adjacent to the Pascua-Lama Project gold mine (which is also owned by Barrick Gold). The Veladero mine, according to researchers, has a reserve of 10 million ounces of gold. In 2014, 722 thousand ounces of gold were produced and an additional 622 thousand ounces were produced. With production increasing year after year, mining appears to be on the rise.

In 2007, Barrick Gold installed a wind turbine on Veladero, setting a world record for the world's tallest wind turbine at 1.28 km above sea level. The nearby Pascua-Lama Project mine covers a quarter of Argentina and three-quarters of Chile, where the mining industry has been criticized. The mines are located next to glaciers, and Chilean activists complain about the negative impact of mining on the environment.

✰ ✰ ✰

8

Gold minerals

More than 30 gold-containing minerals have been discovered in nature.

Of these, 15 are gold minerals:

- native gold with admixtures of silver, copper, etc.,

- electrum Au and 25-45% Ag,

- porpesite AuPd,

- cuprous gold,

- bismutaurite (Au, Bi),

- native gold,

- iridescent gold,

- platinum gold

- golden silver - kustelite

(Au approx. 10-20%) - and others

The remaining gold-bearing minerals are represented by gold tellurides

:

- calaverite AuTe2 (40-43% Au),

- krennerite (Au, Ag)Te2 (approx. 40% Au),

- sylvanite (Au, Ag)Te4 (25-27% Au),

- petzite Ag3AuTe2 (25% Au),

- mutmanite (Ag, Au)Te,

- montbraite Au2Te3,

- nagiagite Pb5AuSbTe3S6

.

Gold is characterized by native

form.

Among its other forms, it is worth noting electrum

- an alloy of gold and silver, which has a greenish tint and is relatively easily destroyed when transferred by water.

In rocks, gold is usually dispersed at the atomic level. In deposits it is often enclosed in sulfides

and

arsenides

.

Native gold is of primary industrial importance

, secondary -

kustelite

and tellurides:

calaverite

,

krennerite

,

sylvanite

,

petzite

.

Very rare are cuproauride

- AuCu2,

rhodite

- Au, Rh,

porpecite

- Au, Pd,

aurostibite

- AuSb2,

maldonite

- Au2Bi, gold sulfide

uytenbogardeite

- Ag3AuS2, etc. Associated components of gold ores themselves - Ag, Cu, Pb, Zn, Bi, As, Sb, Te, Hg, W, Sn, Co, Ni.

In nature, there is a natural alloy of gold and silver called electrum. When developing ore deposits of solar metal, accompanying valuable chemical elements are extracted from the rock: iridium; platinum; osmium; ruthenium; palladium; nickel; copper.

Native gold

| Native gold is a natural solid solution of Au + Ag. The silver content in native gold is up to 10%. There are signs of discontinuity in this series: significantly different prevalence of native gold of different grades (prevalence 930-900, 820-780, 650-600, extreme rarity - 550) to golden silver - the so-called. kustelita . Characteristic is the phase heterogeneity of native gold individuals with separation of phases of the composition Ag, Ag3, Au, AgAu. Native solar metal is not a chemically pure material; it always contains impurities: silver (up to 50%); copper (up to 20%); gland; mercury; bismuth; platinum group metals; tellurium Common impurities are Cu (0.001-0.9%), Fe, Mn, Pb, less commonly Bi, Sb, Hg, Te, Se, Pt, In, etc. (0.00n - 0.n%). With increased amounts of impurities, varieties of native gold (mostly rare) are distinguished: cuprous gold, bismuth gold, iridium gold, platinum gold, etc. Natural amalgams of Au are known. Impurities of Ag, Fe and others are often concentrated in the growth zones of native gold individuals and along the boundaries of grains or in their individual areas. Native gold contains inclusions of carbon dioxide and other gases. The composition of native gold depends on the type and depth... |

Olympics, Russia

Olimpiada is the largest deposit owned by the largest gold mining corporation in Russia. The deposit is located in the Krasnoyarsk Territory. Olimpiada resources are estimated at 47.37 million ounces with a reserve of 30.01 million ounces of gold. In 2014, 727 thousand ounces of gold were mined at the Olympics. In order to process sulfide ores, Olympiada uses its own bio-oxidation technology - BioNord.

is the 8th largest gold producer in the world. It is believed that 90 million ounces of proven gold are located at 5 gold mining operations in Siberia and the Russian Far East. Polyus Gold is the largest gold mining corporation listed on the London Stock Exchange (PGIL).

The owner is Suleiman Kerimov, a mysterious investor who has not given any interviews for more than 20 years. Mr Kerimov made his fortune working in the Russian oil industry, but since 2005, when he bought Polymetal, he has delved deeper into the gold and silver mining industries. The company's headquarters is located in Moscow.

✰ ✰ ✰

7

Content:

- 19th century surge in gold mining and location of deposits

- The largest gold mines in Russia

- The largest gold deposits in the world

The jump in production in the 19th century was justified by the fact that it became technologically possible to process gold ore containing inclusions from primary deposits. Previously, gold was washed and dug only in its pure form from placers. According to statistics, no more than 7% of the world's total reserves are mined in alluvial gold deposits; the remaining deposits are extracted from bedrock ore. Nowadays, the amount of gold in placers is decreasing due to active mining for centuries.

The world's gold deposits are distributed unevenly, which is clearly seen in the diagram of the available gold in the depths of different countries.

With all this, gold deposits in the world do not coincide with the position of states in actual gold production. Everything is explained by the fact that sometimes the largest deposits are not always developed, and the gold contained in the ore is only listed on the state balance sheet. For example, in the largest gold deposit in Russia, Natalka, there is currently no mining.

If we talk about precious metal reserves in Russia, Yakutia, Eastern Siberia, the Amur region, and the Far East are considered to be the richest in gold.

Cortez, USA

In recent years, production at the Cortez deposit has decreased by 48%, due to a gradual transition to underground mining.

The Cortez gold mine is located in Nevada. The open pit and underground mining complex is located approximately 70 miles southwest of Elko. The entire complex includes the underground Cortez Hills mine as well as two open pit mines. Cortez is owned by , headquartered in Toronto, Ontario, Canada.

✰ ✰ ✰

6

Goldstrike, USA

Goldstrike and Cortez actually tied for 6th place in terms of production in 2014. Since production is decreasing at Cortez, it is reasonable to assume that Goldstrike produced more in 2015. The Goldstrike Mine is located northwest of the Carlin Mine off the Carlin Trend.

Goldstrike also owns , which acquired the mine in 1987. Before this, the mine belonged to PanCana, which operated it as a joint venture since 1978.

The mine consists of three deposits. One of them is the Betze-Post open-pit mine. The remaining mines are Meikle and Rodeo, which are underground.

✰ ✰ ✰

5

The largest gold mines in Russia

The central active deposits of the Russian Federation belong to the primary type; they have been exploited since the times of the Soviet Union. These are the following mines:

- The Berezovskoe primary deposit, where mining has been carried out since the mid-18th century, continues to this day.

- Vorontsovsky mine, located in the Sverdlovsk region. Its operation began relatively recently - in 2000. It is worth noting that it was here that the technology of heap leaching of gold at subzero ambient temperatures was tested for the first time.

- Sukhoi Log is a substantial deposit in Eastern Siberia, notable for its impressive gold reserves, but with a low gold content in the ore. At the moment, there is no industrial development on it.

- The Natalka deposit is a rich mine, which is also not used in our time.

The Russian Federation does not hold the leading position in gold reserves, however, given the gigantic area of unexplored lands in the North, the situation may change in the future.

The increase in the rate of gold mining is associated with the development of technology for obtaining gold from rock. Thus, in 2015, the global production of pure gold amounted to more than 3,200 tons - this figure was registered as a historical maximum.

You might be interested in: History of gold mining

Carlin Trend, USA

Carlin Trend in the USA belongs to . The deposit is located in Nevada and includes open pit and underground mining.

The Carlin Trend, an area 8 km wide and 84 km long, is part of a gold belt in the Carlin area of Nevada. Gold was discovered in the area in the 1870s. Due to the harsh conditions of the region, virtually no mining took place until 1909. Even before 1964, they could barely produce about 22,000 ounces annually. From 1964 to 2008 Carlin Trend produced 70 million ounces of gold worth about $85 billion.

✰ ✰ ✰

4

Fully financed drilling

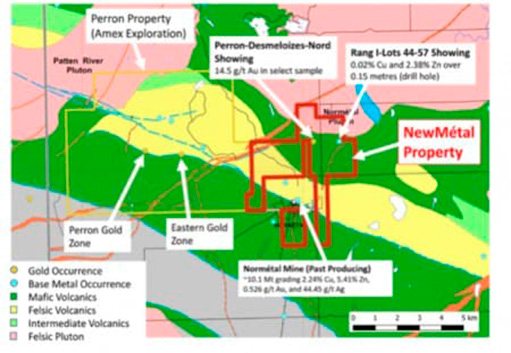

But Starr Peak (TSX: STE.V; OTC: STRPF) isn't relying solely on Amex's results. Not at all. The company has finances for drilling. Why? Because the Amex deal was more than just a land acquisition, it convinced some of Amex's directors to join Starr as shareholders. Right now the company is identifying development target points.

Starr signed a contract with leading geological consulting firm Laurentia Exploration, the same firm that helped Amex discover the deposit.

In early September, Starr launched research into a VTEM (universal time domain electromagnetic) system at the main site of its NewMétal property. It also began high-resolution drone geophysical surveys throughout the area, including the new Rousseau and Turgeon Lake Gold deposits.

Yanacocha, Peru

Yanacocha is part of a large mining operation in the Cajamarca region of Peru. The Yanacocha deposit is located 28 km north of the city of Cajamarca and 770 km from Lima. This open-pit mine is considered the 4th largest in the world, although production has been declining. The mine produced 970 thousand ounces of gold in 2014, up from about 1 million ounces in 2013.

Yanacocha is majority owned (51%), the second largest gold mining company in the world, located in Colorado, USA. The Peruvian company Buenaventura owns a 44% stake in the mine, with the World Bank owning the remaining 5%.

✰ ✰ ✰

3

Small-Cap Companies Behind Big Discoveries

After years of cutting costs, gold miners are now willing to spend on exploration around the world. But this is no longer a game for giants. Big mining companies don't do exploration these days. Instead, they let fledgling businesses do the heavy lifting and then buy them up when they make a major discovery or confirm the presence of gold and other precious metals in the soil during the development phase.

That's why young miners have so much opportunity - so much so that Wall Street expects them to outperform the market, and even short sellers are now staying away from them.

The upside is some very simple math: when you're a start-up gold miner with a tiny market cap and you find a potentially large deposit, your stock skyrockets. This is how millionaires are born.

Pueblo Viejo, Dominican Republic

The Pueblo Viejo field is only slightly behind the next number, Grasberg. In 2014, 1.108 million ounces of gold were produced here. Pueblo Viejo is a relatively new mine, jointly owned by Barrick (60%) and Goldcorp (40%). The mine, researchers believe, has significant reserves, so it will remain a vital source of gold for our planet for several decades to come.

Pueblo Viejo is a small city on the southern coast of the Dominican Republic, located approximately 60 miles from Santo Domingo. The state corporation Rosario Dominicana first began mining gold here in 1975, producing 5 million ounces of silver and gold over the next 16 years. When the price of metals dropped significantly in 1991, the mine was closed.

In 2001, Canadian company Placer Dome won a contract to operate the mine for 33 years. Barrick Gold, the world's largest gold mining company, purchased Placer Dome in 2006 and resumed gold mining in 2009.

✰ ✰ ✰

2

Grasberg, Indonesia

Grasberg in Indonesia has long been the world's leading gold mine. It is still touted as the largest mine in the world, and the third largest copper mine. Currently, Grasberg is an open pit mine, but by the end of 2021, production will move to the underground part of the deposit. In 2014, Grasberg produced 1.1 million ounces of gold.

The owner of the field is Freeport-McMoRan, which owns 90.64% of the shares. The company has 19,500 employees. The Indonesian government owns the remaining 9.36% of the mine. Grasberg is located near Mount Jaya in Indonesian New Guinea. Jaya is the highest mountain in Papua, and therefore extraction of rocks is a particularly labor-intensive process here.

The deposit was discovered in 1936 by Dutch geologist Jean-Jacques Dozy, although it was not developed until 1960, when George Mealy (CEO of Freeport-McMoRan) and Forbes Wilson sent a special expedition to prove the value of the deposit. When Indonesia gained independence in 1963, Grasberg became the first mine opened by the Suharto government.

✰ ✰ ✰

1

Muruntau, Uzbekistan

In recent years, Muruntau in Uzbekistan ranks 1st in terms of production volume, overtaking Grasberg. In 2013 and 2014, the competition between them was not even close. Muruntau produced 2.52 million ounces of gold in 2013 and 2.6 million in 2014. This is a huge open pit, according to scientists, there are still about 170 million ounces of gold reserves here, so at the current level of production, the mine could be a leader within the next 60 years.

Muruntau belongs to the Navoi Mining and Metallurgical Combine, which belongs to the state of Uzbekistan. The plant was founded in 1964 as part of the gold mining enterprises of the Soviet Union. The world's largest BIOX plant has been put into operation here to combat the depletion of oxide ore reserves.

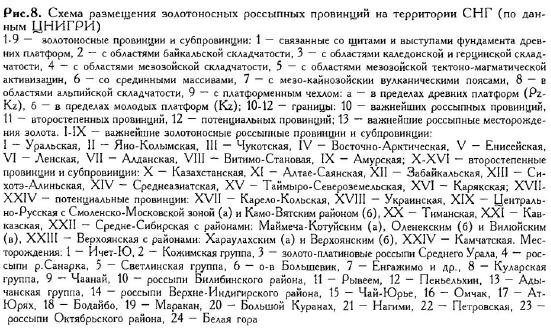

General information about gold placers, their role in the raw material base and production

Native gold is the oldest metal mined from placer deposits, the history of which dates back to ancient times.

Almost the entire history of mankind, especially the discovery and development of new lands, was to a greater or lesser extent associated with the search for new sources of gold, which for a long time were primarily alluvial deposits. In Russia, the first development of placers - in the Urals and in the Yenisei Ridge - relate to beginning of the 19th century In the second half of the 19th century, large discoveries of gold placers were added to them in the Lena region, in the Amur region, and in Transbaikalia. A new rise begins in the late 30s of the 20th century, when the discovery and development of the unique gold alluvial areas of Yakutia and Kolyma brought the Russian gold mining industry to one of the first places in the world. Subsequently, due to the discovery of primary gold deposits and complex gold-bearing ores of non-ferrous metals in various regions of the former USSR, the role of alluvial deposits in the total gold reserves decreased, but still remained high in its production. In the last period of existence of the former.

It is characteristic that nowhere in the world are alluvial gold deposits exploited so stably. Typically, placer mining has the character of “gold rushes”, alternating with periods of decline. In Russia, the decline in production was largely restrained by artisanal mining and stage-by-stage development of deposits, and the increase in reserves was stimulated by a constant increase in estimated prices per gram of gold (in the former USSR - almost every five years).

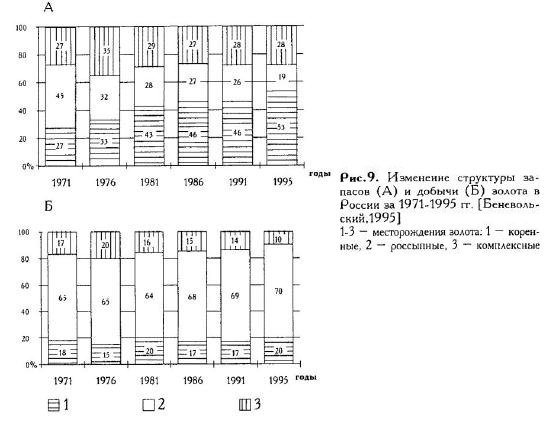

Russia is the only country with large-scale gold mining, where about 70% of it is obtained from placers, the reserves of which account for only 20% of the total (Fig. 9) and predicted resources - only 9%. At the same time, according to V.N. Mosinets (1991) in the main gold-producing countries, production from placers is 2.3%. A significant part of the gold potential of Russian placers is located in hard-to-reach areas of Siberia and the Far East. In the current economic environment, its implementation is associated with large investment risks, social, environmental and legal difficulties (see Fig. 9). In addition, reserves and predicted resources of placer gold are dispersed across numerous sites, which complicates their industrial development.

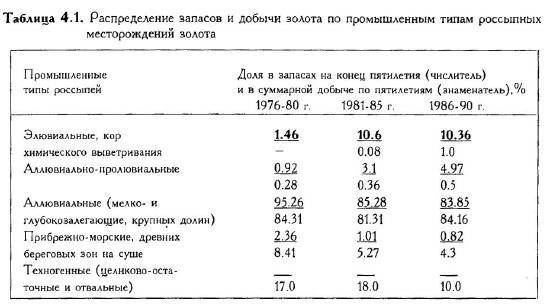

The leading industrial type of placers, which retains its industrial importance (84% in reserves and production), is alluvial with shallow and deep-lying layers and placers of large valleys. If we compare the period from 1976 with the present time, their share in reserves and production has decreased slightly due to the increase in metal reserves in gold-bearing crusts of chemical weathering and its extraction from technogenic deposits (Table 4.1). In the future, taking into account the predicted resources, alluvial placers remain the main producers of gold, even if the quality characteristics and mining and geological conditions of mining have changed for the worse.

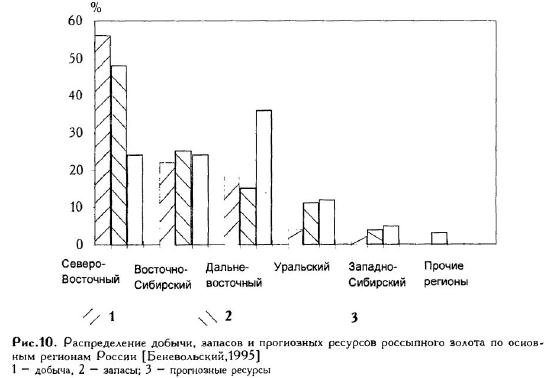

In the distribution of reserves and production of alluvial gold, the leading place is occupied by the Northeast - the Magadan region and Yakutia (Republic of Sakha) (Fig. 10), and the role of the former has decreased by almost half over the last 25-30 years of the existence of the USSR. Today, this process has become even more aggravated, having taken on a largely “landslide” character. The role of “old” placer deposits in the southern regions of Siberia (Lensky region, Aldan, Amur region, mountains of Southern Siberia) and the Urals is significantly increasing again, where, during the period of geological exploration work focused on the North-East of the country, a significant reserve of poorly explored areas and unexplored deposits was formed, in including placers of non-traditional types, such as placers with fine and thin gold, placers in fault depressions, placers in karst, etc. Finally, an important gold mining reserve is represented by technogenic placers, primarily the stale dumps of artisanal mining and mines that have accumulated over many decades.

The resource base of placer gold is located in 30 constituent entities of the Federation and consists of more than four thousand objects. At the same time, 67% of reserves and 56% of predicted resources fall on five subjects: Magadan, Amur, Irkutsk regions, Sakha (Yakutia) and Chukotka.

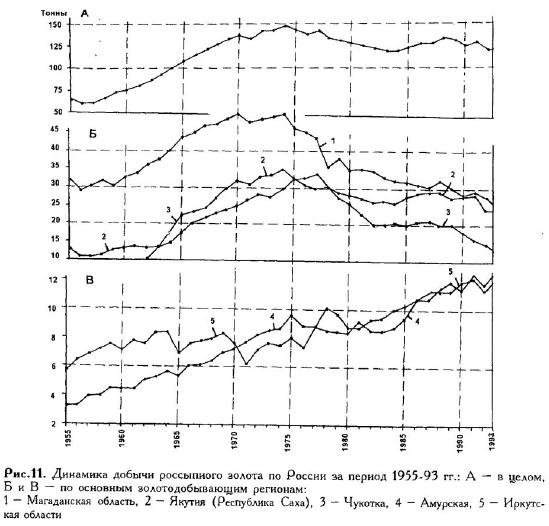

The state of SMEs in each of these regions varies markedly (Figure 11). For example, the Magadan region, which produces approximately a quarter of Russia's placer gold, has only 15% of proven gold reserves and only 6% of predicted resources. Since the beginning of work (the 30s), approximately 2,500 tons of placer gold have been mined in the Central Kolyma regions. For several decades before the discovery of primary deposits in Uzbekistan, this largest gold placer region in the world was the main producer of gold in the USSR (see Fig. 11). Almost all Kolyma gold comes from alluvial placers (Berelekh, Debin, Orotukan, etc.) of Quaternary age. Only placers located at a depth of 150 m (Malyk-Sienskaya depression) are considered more ancient (Neogene). The reserves are dominated by Upper Quaternary (34%) and Upper Quaternary-Holocene (48%) placers, most of which lie at a depth of up to 10 m. The bulk of gold was mined from placers in small and medium valleys.

The second most important producer of alluvial gold is Sakha (Yakutia), which supplied a fifth of the gold (about 1000 tons) and has a slightly larger balance of proven reserves - 22% and 11% of predicted resources. The development of placers in Yakutia began at the turn of the 20th century in its southern part, in which more than 300 tons were mined over the past period. Then placers began to be intensively mined in Aldan, in the Allah-Yunsky, Verkhne-Indigirsky, and Kularsky regions. In recent decades, the republic has occupied a stable second place in alluvial gold mining (Fig. 11B). Until recently, alluvial shallow Quaternary placers (Nara, Olchan, etc.) absolutely predominated among the placers of Yakutia. However, with the assessment of the ancient deep placer of the river. Bol.Kyranakh with a thickness of gold-bearing strata of 60-80 m, which is the standard (genotype) of placers of the so-called “Kuranakh type” with small and thin gold, placers of increased thickness began to play a significant role in the raw material base of the region.

The gold-bearing areas of Chukotka provide 13% of gold (the total amount of mined metal is 8000 tons) with their share in reserves of 10% and in predicted resources of 5%. With the predominance of alluvial shallow placers in small and medium valleys, a significant part of the gold is also extracted from deep-lying polygenic placers of coastal depressions ( We are digging, with a production of about 200 tons).

The Lensky gold-bearing area, developed for 150 years, was distinguished by its wealth and amount of gold mined and ranked second in Russia; In total, about 1150 tons of gold were obtained from placers here. Currently, its production is about 10%. A feature of the area is the predominance of rich buried placers of early Quaternary, and to a lesser extent, middle and late Quaternary age, from which in total about 90% of all gold mined from placers in the region was obtained. They are confined to small and medium-sized valleys (Maracana, etc.)

In the Amur region, over 125 years of placer development, about 700-800 tons were mined, mainly from shallow Quaternary placers in small and medium valleys. Placers of large valleys are also known (the Selemdzha River), and in recent years multilayered continental placers of near-fault basins have been discovered (Nagiminskaya, Yasnopolyanskaya).

Over the 175-year history of the development of Ural placers, over 900 tons of gold were extracted from them. Geological and geomorphological features of the development of the Urals - the duration of the continental stage, deep weathering of bedrock and gold ore bodies, leveling of the relief during the long Meso-Cenozoic period led to a wide variety of age types of placers. Along with the most productive and widely developed Quaternary placers, Neogene, Paleogene, Cretaceous and Jurassic placers are known in many gold-bearing nodes of the Urals. The basis of the raw material base is shallow placers of small and medium-sized valleys, and as they are mined, the importance of placers of thicker strata (up to 50-60 m or more) and technogenic ones increases.

The Yenisei Ridge, where about 900 tons of metal was mined over more than 150 years, is an example of a placer region with a very high concentration of gold. As in other areas, the basis of the raw material base was alluvial shallow Quaternary placers of small and medium valleys. Karst phenomena are quite widespread, complicating the mining of placers. Some karst depressions contained rich placers (Ognevskaya).

An analysis of the resource base of placers by mining methods shows that the most technologically advanced and rapidly developing, thanks to the use of high-performance earth-moving equipment, open separate mining method accounts for 65% in production, and noticeably less in reserves - 53%. The levels of extraction by dredge and hydraulic methods are close - 13 and 14%, but in terms of the specific gravity of reserves they differ significantly: for dredge it is 28, for hydraulic - only 11%. The underground method of development is the least developed compared to others. It is most common in the northern subpolar and polar regions: in Chukotka, where its production is greatest (up to 4.5 tons) and in Yakutia (2 tons). In recent years, due to the advent of highly productive earth-moving equipment, it has become cost-effective to develop placers previously explored for the underground method in an open, separate manner at depths of up to 20-25 m, and in some cases up to 40 m or more. The excess of dredged gold reserves over its production is explained by the slow development of deposits due to the insufficient equipment of enterprises with a dredging fleet. Currently, more than 150 dredges operate in Russia, yielding up to 16 tons of gold per year, or a little more than 100 kg per installation. For this reason, in recent years, the reserves of a number of dredge sites have been converted to an open separate method of mining. At the same time, due to changes in mining technology and the contours of industrial reserves, quite significant irreversible losses of metal occurred in the subsoil.

Today, the mineral resource base of placer gold in Russia includes more than 4,000 objects (or sections thereof), since some deposits are divided into separate independent areas and are accounted for as independent objects. Almost half of all reserves are contained in deposits from 1 to 5 tons, a quarter in very small placers, the remaining reserves are distributed equally between the smallest and largest placers. The main role in mining is played by very small placers, numbering almost 900 (Table 4.2).

Gold production from placers, after its peak in the 70s (see Fig. 11), has been steadily declining, reaching the level of 1966. The most significant drop in production occurred in the main gold-bearing regions of Central Kolyma and Chukotka. At the same time, a significant increase in production took place in the Amur, Irkutsk, Chita regions, Krasnoyarsk Territory, etc. However, the increase in alluvial gold production in these areas did not compensate for its decline.

There are several reasons for this negative phenomenon.

(1) Deterioration in the quality characteristics of gold-bearing sands. From 1973 to 1992, i.e. over twenty years of operation of placers, the gold content in mined dredge sands decreased by 28% and today is about 180 mg/m3; in open, hydraulic and underground methods the reduction was approximately 50%, reaching 90, 230 and 310 mg/m3, respectively. The deterioration in the quality characteristics of sands is a consequence of the completion of the mining of such large and rich placers as Ryveem, Pil-khinkuul, Kularskie, Burkandya, etc.

(2) Complicating the mining and geological conditions of placer mining, especially in old gold-bearing areas, where the depth of opening of landfills has increased. According to V.P. Pluteshko, only from 1965 to 1990, the cost of mining alluvial gold in Russia increased five to six times and has now approached a critical point - the purchase price, beyond which a collapse in production cannot be ruled out. The environmental load has reached a critical state, especially in the regions of the Far North.

The progressive depletion of the resource base in the most important gold-mining areas has led to the fact that enterprises in the Magadan region, Chukotka, partly Sakha (Yakutia) and some others have proven reserves in exploited, developed and reserve deposits for a period of less than 10 years. Maintaining gold production from alluvial deposits at the level of 110-120 tons/year is only possible under the condition of intensive reproduction of small and medium-sized gold mines with an increase in capacity in promising areas (Amur region, southern Western Siberia, Tuva, etc.) and preventing its sharp decline in old mining regions. However, due to a threefold decrease in investment in geological exploration in 1991-1995 (to the level of the 60s), the increase in reserves also decreased adequately. A very alarming point is also the reduction by one third of the predicted resources of alluvial gold, i.e. the base from which industrial reserves are drawn (Fig. 12). In addition, with modern taxation, a significant portion of mining enterprises are considered unprofitable. As TsNIGRI studies have shown, among reserves for open-pit mining, up to 35% are such, and among dredge landfills - up to 40%.

However, despite the objective difficulties of the transition period, negative indicators of the state of the mineral resource base of placer gold in Russia, its potential is still high enough to maintain the achieved level of gold mining for about 10-15 years during the period of conversion of the gold mining industry from placer to ore mining.